It’s tax season again.

If you typically get a refund, this can be an exciting time, and you might look forward to it! For others, it might result in anxiety, frustration and a big bill. Plus, add in the general confusion surrounding taxes, and it can all become one big headache!

Here are some important things to know about taxes that might ease that headache a bit.

The current W-4

In 2020, the Internal Revenue Service (IRS) made significant changes to the tax withholding process, starting with the W-4 form. Before 2020, the money withheld from your paycheck was based on how many “allowances” you claimed on your W-4.

These are no longer used. According to the IRS, this change was meant to increase transparency, simplicity and accuracy of the form. In the past, the value of a withholding allowance was tied to the amount of personal exemption. Due to changes in the law, currently you cannot claim personal exemptions or dependency exemptions. You might be thinking, “What does that even mean?”

Let me try to explain.

The allowances on the old W-4 helped determine how much was taken out of your check each payday. The fewer allowances you claimed, the more money was taken out for taxes, and vice versa. Many purposely kept their allowances low to get a bigger tax refund at tax time — talk about enforced saving!

Others would intentionally raise their allowances to increase their take-home pay. While there was nothing illegal about that, it meant a larger tax bill the following year, and many people found themselves in debt as a result. Now, your withholding is based on the number of jobs and amount of income in your

household, as well as your tax filing status (single, married filing jointly, married filing separately, or head of household).

The best thing to do is to complete a “paycheck checkup” using the withholding calculator at the IRS website. You will need your (and your spouse’s, if applicable) most recent pay stubs from each job and about an hour to answer the questions.

This will help you decide if you need to raise or lower your withholding by filling out a new W-4. Have more questions? Visit the FAQ page at the IRS.

Tax credits

Tax credits reduce your tax bill by giving you dollar-for-dollar credit toward what you owe. For example, if you are eligible for a $500 tax credit, your tax bill will be reduced by $500. Tax credits can be refundable or non-refundable. Non refundable tax credits are the most common and can be used to reduce your tax to zero, but not below. Some examples of non-refundable tax credits include the Adoption Tax Credit, the Child Tax Credit and the Mortgage Interest Tax Credit.

Refundable tax credits allow you to reduce your tax liability and will provide a refund. The most well-known example is the Earned Income Tax Credit, which provides a subsidy for low-income working families. Learn more about eligibility.

There are also partially-refundable tax credits. As the name implies, these credits will reduce your tax bill, but if your bill goes below zero, only a portion of the credit may be refunded. A good example of a partially-refundable tax credit is the American Opportunity Tax Credit, which is a credit for tuition paid at higher institutions of learning. Learn more about education-related tax benefits.

Even if they aren’t refundable, tax credits are more valuable than tax deductions, as they reduce the actual tax you owe.

Tax deductions

Tax deductions reduce your taxable income. There are two types of deductions: above-the-line deductions and below-the-line deductions. The line is your adjusted gross income. Above-the-line deductions are specific expenses you can subtract (or deduct) from your gross income to calculate your adjusted gross income. This makes them valuable for reducing your overall taxable income. Some examples of above-the-line deductions are payroll deductions like health insurance premiums, retirement contributions, student loan interest, alimony payments, educator expenses, and business expenses.

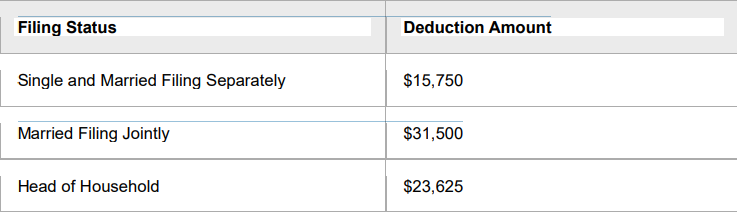

Below-the-line deductions reduce taxable income from adjusted gross income. The most well-known are itemized deductions and the standard deduction. Taxpayers can choose to itemize deductions or take the standard deduction but can’t do both in the same year. The standard deduction is a flat amount based on filing status, and the amount changes (adjusts for inflation) each year.

The standard deductions for 2025 are:

Itemized deductions are specific expenses that taxpayers can subtract from their adjusted gross income to reduce their taxable income. These deductions include expenses like state taxes, charitable donations, expenses for people who are self employed, and business expenses for small businesses. They require proof of the expense, and the taxpayer must fill out specific forms (or schedules) to claim them. For many taxpayers, the standard deduction will reduce their taxable income at a much higher amount than itemized deductions would.

The One Big Beautiful Bill, passed by Congress in July 2025, extended many tax deductions and eliminated some as well.

It’s important for taxpayers to not assume that they will be eligible for the same deductions this year that they were in previous years. Also, some deductions phase out at certain income levels. It’s always prudent to consult with a certified tax professional to ask if you are eligible for a specific deduction.

Filing status

There are four different filing statuses: single, married filing jointly, married filing separately, and head of household. Your

filing status matters in many ways. It will determine how much you can claim for a standard deduction, which credits and deductions you might be eligible for, and what your tax brackets are. If you are married, filing separately might significantly increase your tax liability. Make sure you research the impact your filing status could have on your situation, or consult a certified tax professional.

Tax brackets

You might have heard of terms like marginal tax rate and effective tax rate, but what do they mean? Tax brackets determine what your tax rate will be, and there are different tax brackets depending on how you file your taxes. Look up your tax bracket here. Brackets are, in my opinion, where most misunderstandings of tax rates occur.

Let’s break it down.

Your income is taxed at different rates at different income levels. Let’s say your taxable income (whatever income is leftover after the standard deduction — or any other deductions — is subtracted) is $50,000 and your filing status is single.

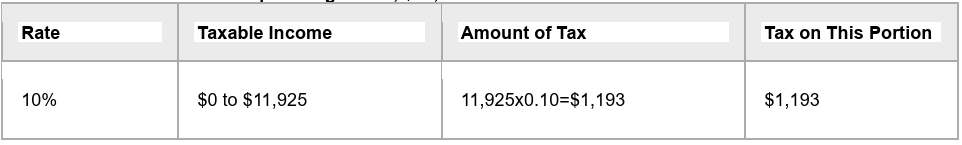

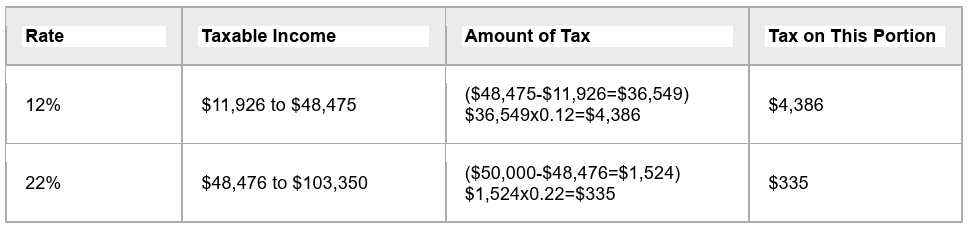

Here is how that income will get taxed:

Tax Bracket Breakdown Example: Single Filer, $50,000 Taxable Income

The person is taxed at all three brackets because their taxable income is $50,000. The first bracket taxes $11,925 at ten percent, which equals $1,193. For the twelve percent tax bracket, the person is taxed on the difference between $48,475 and $11,926, which equals $36,549. Now, the $36,549 is taxed at twelve percent, which is $4,386. For the 22 percent tax bracket, the person is taxed on the difference between $50,000 (their total taxable income) and $48,476 which equals $1,524.

Now, the $1,524 is taxed at twenty two percent, which is $335. The total amount of tax between all three brackets in this scenario equals $1,193 plus $4,386 plus $335, totaling $5,914 that person owes in taxes. In this scenario, the marginal tax rate is 22%, because that is the rate of the last dollar that was taxed. The effective tax rate, the percentage of tax paid on the total taxable income, is 11.8% ($5,914 is 11.8% of $50,000).

Tax preparation assistance There you have it; some important things to know to help you understand your taxes better and get you ready to file away! If you are not quite ready to figure it out on your own, don’t worry. Tax preparation assistance is available!

Check out free filing programs at the IRS website, visit your local Volunteer Income Tax Assistance location if your household earns under $54,000 a year, or find your local Tax Counseling for the Elderly location for free help in filing taxes. In Minnesota, individuals who earn $40,000 or less per year, families who earn $70,000 or less per year, and self-employed people who earn more than $10,000 and less than the thresholds for individuals or families can meet with our friends at Prepare and Prosper for free tax help. If you’re more of a “do-it-yourself (DIY)” kind of person and you made less than $84,000 in 2025, Prepare and Prosper offers DIY resources for free.

Tax time is a good time to revisit your financial goals for the year, which starts with a budget. Our certified, nonjudgmental financial counselors can work with you to create a budget and provide ideas for ways you can most effectively use a tax refund to work toward achieving or improving your financial wellness.

Please note that our financial counselors are not certified tax professionals, and this blog should not be taken as tax advice. For tax guidance, please contact a certified tax professional.

Author Shannon Doyle is program manager for partnerships and education with LSS Financial Counseling.

North Star Credit Union offers six free financial counseling sessions through LSS Financially annually for members.

📞 Call 888.577.2227 to schedule an appointment with one of our certified financial counselors or get started by creating a financial profile.

Let them know that you are a member when you call.